While I like the 4 Parliament comparisons, one of the problems with them is that they become dated. Being written at different times doesn't help either, as that can make it hard to compare the various households I've covered, particularly the results from Parliament 43 (the current period). With that in mind I thought I'd update just the Parliament 43 results for all the households I've covered so far, plus a few extras. That will make comparisons between household types easier and also allow gossip about which ones are in and out of favour.

The format will be a bit like the 4 Parliament posts, but instead of Parliaments I'll compare the households and then look at each one in more detail. It's important to bear in mind that these charts are comparing two different but otherwise identical households at the start and end of the period, not the same household. So, if we look (for example) at a single Newstart allowance recipient with an income of $20,000 a year, we are comparing today's result with what would have been the outcome for a single person on Newstart with the equivalent private income (ie, CPI adjusted) at the start of the period.

Similarly, the results for 55 year olds are a comparison of a 55 year old at the start of the period with a 55 year old at the end, not the original 55 year old person (who would by now be 57 or so).

I'm going to cover 9 household types, so the initial comparison will be spread across 2 charts to reduce clutter. As I said, the single parent material has been of most interest so let's start with the chart that includes them.

Chart 1

I've put 5 different households here:

- single parents on Newstart allowance (NSA)

- single parents on parenting payment (PPS)

- single parents on PPS at the start of the period compared to NSA at the end (this reflects the loss of the "grandfathering" status)

- single Austudy recipient (with a HECS or HELP debt)

- single Newstart allowance

There are two clear standout "winners" in this group of households, at least at the lower income end - Austudy recipients and single parents on Newstart allowance. In both cases the main gains stem from changes to the income test for the respective income support payments. There are also gains for single Newstart and single parents on PPS. The worst losses over the period are in respect of the grandfathered PPS group who will lose their entitlement to that payment on 1 January 2013 (the trace used here assumes a transition to NSA where eligible).

I'll look at each of these in more detail later, but before that here are the rest of the households.

Chart 2

NSA appears in this chart as well, as a kind of benchmark. The other cases are:

- single NSA aged 55 (to illustrate the effect of the removal of the mature age workers tax offset or MAWTO)

- single income NSA couple (to illustrate the effect of removal of the dependent spouse tax offset or DSTO)

- single income NSA couple aged 55 (to illustrate the combined impact of the loss of DSTO and MAWTO)

- single age pension.

The big losers are the single income couples, especially where loss of MAWTO also comes into play.

Next I'll look at each household separately using a chart that shows how much components of the tax transfer system changed in each case.

First up, the "benchmark" single NSA case (originally covered in a 4 Parliament version here).

Chart 3

Here we have gains at incomes up to roughly $38,000 and losses at pretty much any income level above this. Most of the gain comes from two sources: tax cuts and the clean energy advance (CEA). Both of these were part of the package of measures that accompanied the introduction of carbon pricing. The small gain attributed to NSA is somewhat misleading - it's due to the timing of the election in 2010 relative to the date on which NSA was increased as part of the normal indexation arrangements.

The losses are due to the lack of tax cuts at higher incomes in the current Parliamentary period (the carbon price related tax cuts were focused on lower incomes and shaded out at higher incomes). There's also a significant increase in the medicare levy, reflecting the introduction of new surcharge arrangements for those without private health cover. I've done the calculations in respect of an uninsured person to illustrate this change, but it should be noted that those with health cover also had reductions in income as a consequence of the winding back of the private health insurance rebate.

Now to single parents. Chart 4 illustrates the changes for non-grandfathered single parents on NSA, with two children aged 8 and 10.

Chart 4

The most obvious change here is the significant boost in NSA for those with private incomes, particularly at around $25,000 where the gain from NSA alone is over 11%. This is due to the income test change for principal carer single parents which takes effect on 1 January 2013 (I've discussed this a little more in an earlier post here). There are also gains stemming from the clean energy advance and the schoolkids bonus. The latter is hard to quantify because the gain from this depends on the extent to which the earlier scheme - the education tax refund - was taken up. If it was taken up in full then there's not really much gain; if it wasn't used for whatever reason then the gain is the full amount shown. That vagueness is why I've coloured it in a wishy-washy way.

At incomes higher than roughly $100,000 a year this type of single parent household has lost money in real terms. Part of this reflects the tax issue discussed earlier, and part is a consequence of the tightening of access to family tax benefit Part A and Part B via non-indexation of income test thresholds. (There's even a small decline in FTB A at low incomes, reflecting the non-indexation of the end-of-year FTB supplements although that's hard to see at this scale.)

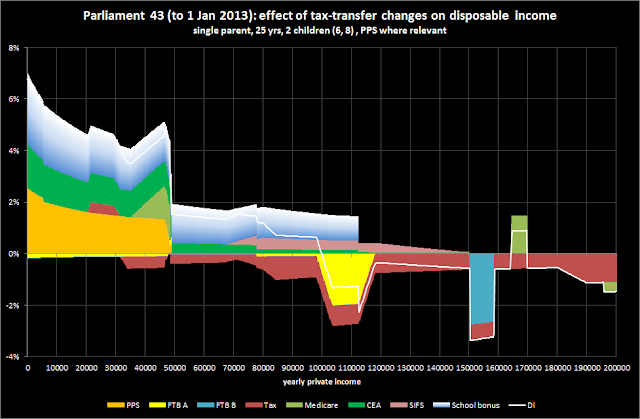

Next up is the other group of single parents I'm looking at who have also gained in real terms - those with young children to whom PPS is payable.

Chart 5

Compared to the single NSA result, the PPS case has a noticeable increase in income support (PPS), but no tax cuts to speak of. This is because PPS still retains many of the features of other pension payments. It's rate is benchmarked to wages growth rather than just CPI and, as pensioners, it's recipients are entitled to the senior Australian and pensioner tax offset (SAPTO). Having access to SAPTO means PPS recipients pay rather less tax than NSA recipients, but consequently don't benefit to the same extent from tax cuts. At incomes higher than the PPS cutout, the results are the same for the NSA case (keep in mind the Y-axis scale is not the same between the charts).

The next chart looks at the single parent group that has had quite a bit of media coverage - those who were grandfathered at the start of the period, but won't be come 1 January 2013. (More detail about the actual change and its impact is in this earlier post).

Chart 6

Given the extent of the coverage I've already given this group I won't say much about this chart, other than a reminder that the comparison here is between the situation in August 2010 (at the election date) and 1 January 2013. The earlier posts have tended to focus on the transition between 31 December 2012 and 1 January 2013, so the numbers will look a little different.

Next, Austudy payment.

Chart 7

Increases in Austudy and the student start-up scholarship are the two standouts in the chart. The Austudy increase is due to relaxation of the income test - in this case an increase in the amount of income students can have before their payment is reduced - and was discussed in this post. The student start-up scholarship is available to qualifying tertiary students (which I've assumed here) but there is a caveat to the figures underlying the chart results. The Government announced in its MYEFO statement that it would not index the scholarship on 1 January 2013 (or the the following 3 years). However, the increase is automatic, in the sense that annual increases on 1 January are already enshrined in legislation. This means that new legislation has to be passed to prevent the increase and to date I've not spotted its introduction into Parliament. So, as a law-abiding citizen, I've included the increase for now. That said, given the scale used in the chart and the expected low CPI, the loss of indexation is not really going to make a particularly visible difference.

The only other noteworthy point is the wiggle in the disposable income change line introduced by HECS/HELP. I've assumed that our student will have a HECS/HELP debt and so I'm including repayments in the calculation at higher incomes. The wiggles are a consequence of the timing of CPI based changes to the HECS/HELP repayment thresholds - they take effect each 1 July and so this representation, being calculated as at 1 January, is yet to have 6 months worth of adjustment.

Next up, a 55 year old single NSA recipient.

Chart 8

If you compare this older single NSA recipient to the younger one depicted in Chart 3 you'll notice that losses occur at rather lower incomes - from roughly $25,000 versus roughly $38,000. Losses are greater from that point up to incomes of around $65,000. This is due to the removal of the mature age workers tax offset (MAWTO), legislation for which was recently passed by Parliament.

I should restate that these charts are comparing the treatment of a type of household at the election date versus January 2013. The removal of MAWTO has been done in a way that means no individual actually has a loss of income. The design merely stops giving it to those who would become newly eligible for it when turning 55. But that's not what my charts are about - I'm showing the effect of rule changes on household types, so it's quite valid to say that 55 year olds at January 2013 are better or worse off by the percentage in the chart compared to 55 year olds in August 2010.

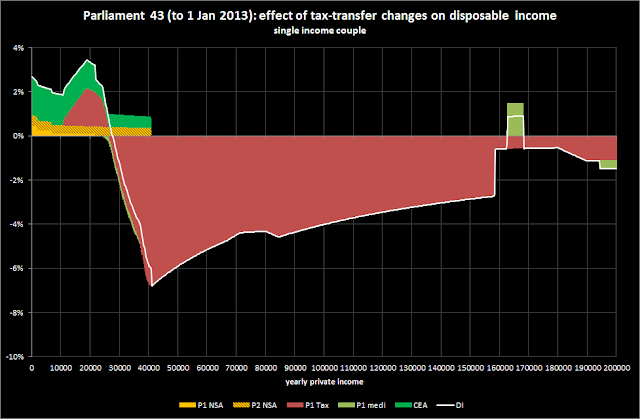

During Parliament 43 the Government also tightened access to another tax offset - the dependent spouse tax offset or DSTO - which affected single income couples. The results for that are in the next chart.

Chart 9

This household type was covered quite recently in one of my 4 Parliament comparisons (here) and given the low CPI results since then there's no marked change. One point to note is that this type of household will gain a little in March when the clean energy advance (shown in green on the chart) is replaced by the clean energy supplement. The design of the clean energy advance meant, in my view at least, these couples were under compensated for carbon pricing effects relative to single people and two income couples. This is overcome once the compensation begins to form part of the actual NSA payment rate, which occurs in March next year. Unfortunately, the same can't be said for the income support bonus, also scheduled for a March introduction, which has the same design problem as the clean energy advance. I've provided a bit of an explanation of this design issue here (but be warned - a commenter on that post described it as boring, to put it mildly).

Note too, unlike the MAWTO change, abolition of the DSTO did actually affect some households, as an entitlement that was available one year was gone the next.

It is of course possible for a household type to be affected by both the MAWTO and DSTO changes. The result is shown in the next chart.

Chart 10

Here we can see the combined effect of the MAWTO and DSTO withdrawal, which, along with all the other modelled bits and pieces, produces an 8% decline in real disposable income at an income of slightly more than $40,000.

Yes, I suppose this is a small group in the overall scheme of things and perhaps it is a little mischievous to include it, but it does illustrate how separate changes can stack together to produce quite significant results. At least I resisted the temptation to compare an August 2010 55 year old grandfathered PPS recipient with a January 2013 55 year old single parent NSA.

All good things must come to an end, and so to my final chart, which looks at single age pension.

Chart 11

This group was covered in an earlier 4 Parliaments post (here) and is largely unchanged since then. The significant real (ie, above CPI) increase in the maximum rates at zero private income is a result of the wages based rate setting mechanism for pension. At incomes higher than the single pension income test cutout, single aged persons have had a reduction in real income relative to their August 2010 counterparts.

A reduction in real disposable incomes at higher private incomes is common to all the households looked at here. Whether this tightening of the system at higher incomes has actually caused a reduction in disposable incomes since August 2010 depends on other factors, particularly wages growth. The reduction shown in the charts is calculated for cases where the income in 2013 is the same in real terms as in 2010, but in fact wages growth has exceeded the CPI over that period, something considered in this post.

Conversely, for all household types (bar one - the grandfathered PPS cases), real incomes have increased at low (or zero) private income. Granted, for some cases (childless NSA for example) the increase is intended to be partly eroded by the impact of carbon pricing, but the general trend remains - the changes made to the tax-transfer system by this Parliament have so far had more of a redistributive emphasis than the preceding three. This seems set to continue - March 2013 sees the introduction of the income support bonus for social security benefits (eg, NSA) and July has an increase in FTB A rates. That means more gains at low or no private income, but as yet, no suggestion of benefits to flow to higher income households.

Parliament 43 still has a way to run yet and we are entering the election year. The pictures presented here could well look quite different by the end of 2013.

Dear Dave,

ReplyDeleteThe National Library aims to build a comprehensive collection of Australian on-line publications by identifying and archiving online publications that meet our collecting scope and priorities. Information about PANDORA, Australia’s web archive and access to archived titles can be found on the Library's web site.

If you could provide an e-mail address and a full contact name to discuss archiving your web site that would be greatly appreciated.

Yours sincerely,

Caitlin Prescott